We are biased by the bell curve

“Rank and yank.” That’s the crude term for the forced ranking (also called “stack and rank”) performance management system used until recently by General Electric, Microsoft, Yahoo and many other companies, perhaps by as many as half of companies as recently as 2009, according to an Institute of Corporate Productivity survey.1

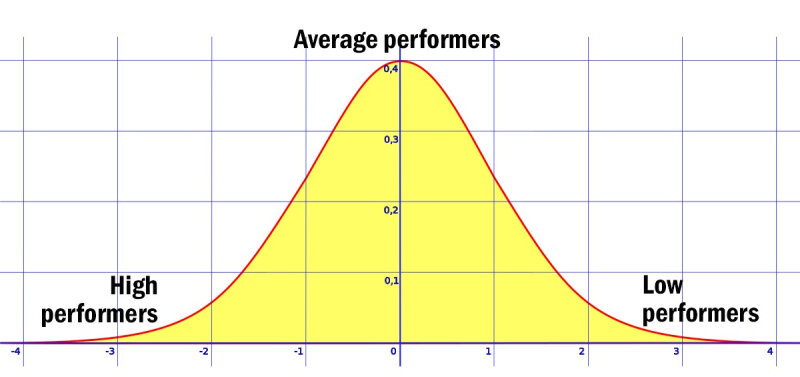

The idea was that employee performance fit the bell curve (also known as the normal distribution or Gaussian distribution). There would be equal numbers of high performers and low performers, but most employees would be average performers. Raises, performance ratings and pink slips would distributed according to the bell curve, with those on one end of the curve (say, the highest ranking 10%) getting big raises and those on the other end of the curve (say, the lowest ranking 10%) losing their jobs. The large swath in the middle would receive average raises, but because of their number the bulk of increased compensation would go to this group.

Easy system to understand and use, right? Except that performance almost never fits the bell curve.

Top workers outperform by 400%!

One powerful example of this is provided by researchers Ernest O’Boyle, Jr., and Herman Aguinis, who in 2011 and 2012 conducted 5 studies involving 198 samples totaling 633,263 researchers, entertainers, politicians, and amateur and professional athletes.2 Consistently, the results they found were remarkably similar: Individual performance was not normally distributed. Instead, they found that performance more closely fit a Paretian (power law) distribution, which can be likened to the shape of a hockey stick. Their conclusion was that the top 5% of workers in most companies outperform average ones by 400%!

Josh Bersin, founder of Bersin by Deloitte, observed that ways in which using the bell curve actually hurts companies include incenting “ultra high level performers” not to collaborate and even leave, not highly motivating mid-level performers to improve, and inefficiently distributing compensation.3

We are drawn to view the world as Gaussian, because it seems simpler and more predictable. “The Gaussian distribution [has the] ability to explain the distribution of most things in nature – height, weight, speed, snowflake sizes and error rates. This distribution is easy to use and has an average and standard deviation that helps predict the future to some extent,” explains the Human Capital Institute.4

'Bell curve bias' afflicts our decision making

In fact, we are biased by the bell curve in many domains of our decision making. For example:

In investing, we discount the possibility of rare and unpredictable large deviations in stock prices.5

In marketing, we want to believe that “there is a meaningful ‘average consumer’ that can be used to scale products and operations around.”6

We are asked to rate Uber drivers, Airbnbs and Yelp establishments on a 1-5 bell curve scale, and yet the ratings cluster above 4. Any person or place rated lower, in essence, fails.7

The implication of our tendency to assume that things are distributed normally is that we have a huge flaw in how we interpret what we see and how we make decisions. Better to step back and see what things look like without imposing the bell curve from the get-go.

NOTES

1 Jena McGregor, “For whom the bell curve tolls,” Forbes, November 20, 2013. https://www.washingtonpost.com/news/on-leadership/wp/2013/11/20/for-whom-the-bell-curve-tolls/

2 O'Boyle, Ernest. (2012). "The Best And The Rest: Revisiting The Norm Of Normality Of Individual Performance.". Personnel Psychology. 65. 10.1111/j.1744-6570.2011.01239.x. http://www.hermanaguinis.com/PPsych2012.pdf

3 Josh Bersin, “The Myth Of The Bell Curve: Look For The Hyper-Performers,” Forbes, February 19, 2014. https://www.forbes.com/sites/joshbersin/2014/02/19/the-myth-of-the-bell-curve-look-for-the-hyper-performers/#1c34f6a76bca

4 “Everything We Knew about the Bell Curve Is WRONG!” Human Capital Institute, December 20, 2016. https://www.hci.org/blog/everything-we-knew-about-bell-curve-wrong

5 Benoit Mandelbrot and Nassim Nicholas Taleb, “How the finance gurus get risk all wrong,” Fortune, July 6, 2005. https://money.cnn.com/sales/major_moments/moneymanage/risk.html

6 John Hagel, “The Power of Power Laws,” Edge Perspectives, May 02, 2007. https://edgeperspectives.typepad.com/edge_perspectives/2007/05/the_power_of_po.html

7 “The Curve is Broken... Fix It!” Northpoint, September 23, 2018. https://www.northpoint-training.com/insights/thought-leadership/178-the-curve-is-broken-fix-it