Case 12: Not missing the opportunity to lose billions

This post is the 12th in my series looking at cases where it seems that "believing we are right" has led to bad outcomes, sometimes even spectacularly bad results, for leaders, teams and organizations.

For my upcoming book, Big Decisions: Why we make decisions that matter so poorly. How we can make them better, I have identified and categorized nearly 350 mental traps and errors that lead us into making bad decisions. The many high-profile situations that I have examined demonstrate the bad outcomes that can be produced by mental traps and errors. My premise is that, at the least,if we recognize and admit that we don't know the answer, we will put more effort into looking for better decision options and limiting the risks stemming from failure when making important decisions.

Our next true story is a classic case of seeing what one wants to see and going with the herd, where everyone ignored mounting evidence right at hand that could have averted what for so many people was financial devastation.

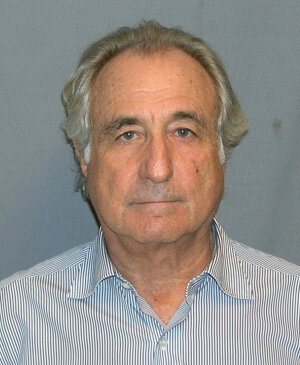

FEELING THE BERN

Bernie Madoff's investors believed that his fund was rock-solid. He promised consistent annual returns of 10% to 12% and seemingly delivered on this promise for years.

HIs Ponzi scheme has cost more than 40,000 investors who believed in him $6 billion in principal, even after recovery of $11.5 billion in investor's funds.

Decades of high returns from Madoff's funds conditioned investors to expect these exceptional returns, despite the easily discovered evidence that such a long string of strong earnings reports was extraordinarily unlikely. Madoff's investors were subject to Optimism Bias (when making predictions, we tend to overestimate the likelihood of positive events and underestimate the likelihood of negative events, and to give more credence to news that reinforces our belief than news that undermines it).

Investors flocked to Madoff because of the Social Proof Heuristic (the tendency for people in ambiguous situations to believe that a behavior is correct to the extent that other people with whom they associate are engaged in it.) Madoff had a long history of involvement in Jewish philanthropic activities and invested money for important Jewish institutions. These connections and his roster of wealthy Jewish clients led others within the Jewish community to invest with him because they assumed that Madoff must be trustworthy. Also, research by Li Huang and J. Keith Murnighan of Northwestern University suggests people were unconsciously attracted to trust Madoff when they should not have trusted him because his closest relatives and associates invested with him.

Madoff used exclusivity and elusivity to play to people's Regret Aversion (behavior being governed by a desire to avoid the pain associated with making poor decisions, in this case to avoid making errors of omission - not wanting feelings of remorse from missing out on an opportunity that others are enjoying). Madoff's investors chose to invest with him because they thought they would regret not taking the transient opportunity when it was open to them. He presented his fund as an exclusive opportunity to which the investors had be invited. He seldom recruited investors and presented the facade that he did not need their funds. He himself was elusive and rarely spoke with his investors. When he did, he said they were exceptionally smart for wanting to invest with him. Madoff knew that an opportunity appearing to be scarce, special or restricted takes on greater value. He understood that the pressure to "act now or this opportunity will disappear" caused investors to process the opportunity using shortcuts, simplification, and superficial analysis.

Ponzi schemes like Madoff's succeed for longer or shorter periods because they play on greed. "Wanting in" and our desire to "get the payoff" can lead us to suspend disbelief and place trust where, indeed, it is misplaced.